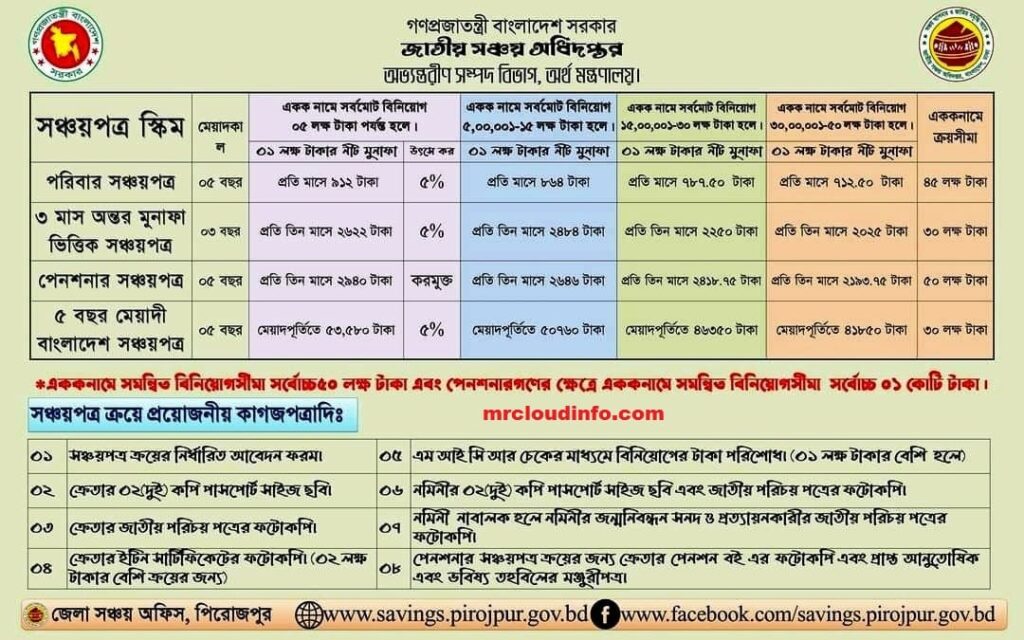

The public authority has decreased the benefit pace of the National Savings Certificate Schemes. On Tuesday (September 21), the Finance Ministry’s Internal Resources Department gave a notice in such manner.

Table of Contents

The rate of profit on national savings certificates decreased from september 2021.

As indicated by the new rate, the benefit rate in investment funds plots up to Tk 15 lakh has been kept equivalent to previously, however the pace of return has been decreased in more plans.

The changed rate will be compelling just for the individuals who purchase new investment funds authentications, the notice said. Also, the new benefit rate will be compelling in the event that you re-contribute after the expiry of the recently bought investment funds authentication. The new pace of return will apply to the two people and associations.

Five-year investment funds:

As per the warning, the five-year investment funds authentication at present returns 11.28 percent benefit toward the finish of the term. Be that as it may, under the new principles, the people who will put more than Tk 15 lakh in these investment funds endorsements will get a benefit toward the finish of the term at the pace of 10.30 percent. What’s more, in the event that you contribute in excess of 30 lakh, the benefit rate will be 9%. Be that as it may, the benefit rate will continue as before up to Tk 15 lakh.

Three-month benefit based reserve funds:

Toward the finish of the term, the three-year term of the three-month benefit based reserve funds declaration is 11.04 percent. It has now been decreased to 10 percent for ventures of more than Tk 15 lakh. Furthermore, with a venture of more than Tk 30 lakh, the benefit will be 9% toward the finish of the term. Be that as it may, the benefit rate will continue as before up to Tk 15 lakh.

Five-year term annuity investment funds:

Toward the finish of the term, the five-year term annuity investment funds for the retired folks would have returned a benefit at the pace of 11.6 percent. Presently the individuals who will put more than Tk 15 lakh in this investment funds endorsement will get 10.75 percent benefit toward the finish of the term. What’s more, in the event that you contribute in excess of 30 lakh, this rate will be 9.75 percent. Notwithstanding, the benefit rate will continue as before up to Tk 15 lakh.

Five-year term of the family investment funds:

Toward the finish of the five-year term of the family investment funds authentication, the benefit rate is as of now 11.52 percent. Nonetheless, from here on out, the benefit rate has been decreased by 10 and a half percent by putting more than Tk 15 lakh in this reserve funds testament. What’s more, if there should be an occurrence of speculation of more than Tk 30 lakh, this rate is 9%. Its benefit rate up to Tk 15 lakh will continue as before.

There has been no adjustment of the overall benefit pace of Post Office Savings Bank. The benefit pace of this plan has been kept at 6 and a half percent.

Three-year term benefit of Post Office Savings Bank:

As of now, the three-year term benefit of Post Office Savings Bank is 11.28 percent. Nonetheless, under the new guidelines, the pace of profit from venture of more than Tk 15 lakh will be 10.30 percent. The venture of in excess of 30 lakh will be 9.30 percent.

Likewise, the current net revenue of Wage Earner’s Development Fund is 11.20 percent. Nonetheless, in the event that you contribute in excess of 15 lakh at the new rate, the benefit will be 10.26 percent. Furthermore, with a speculation of multiple million, the benefit will be 9.33 percent. In addition, if the speculation is in excess of 5 million, the benefit will be accessible at the pace of 8.40 percent.

If you like this post please share and click here to see new post. Thank you!!